Written by Shuli Lo

Translated by H.B. Qin

Edited by Andrew Larracuente

On February 10, when many people were celebrating the Chinese New Year with friends and family Tzu Chi USA Headquarters volunteers came early on the first day of the Chinese New Year to help the people of El Monte, Southern California to file their tax returns free of charge. Many people who used to file their tax returns elsewhere are now turning to Tzu Chi because the tax return filing service by Tzu Chi’s volunteers has established a good reputation in the community.

Tax Return Preparation Service is free but the quality is assured

In 2007, Tzu Chi USA Headquarters partnered with the U.S. Internal Revenue Service (IRS) and became an accredited organization that is qualified to provide “Volunteer Income Tax Assistance” (VITA) services. Every tax season, all Tzu Chi volunteers who have been trained by the IRS in tax return preparation services provide free tax return preparation services to eligible individuals and families at Tzu Chi’s local offices.

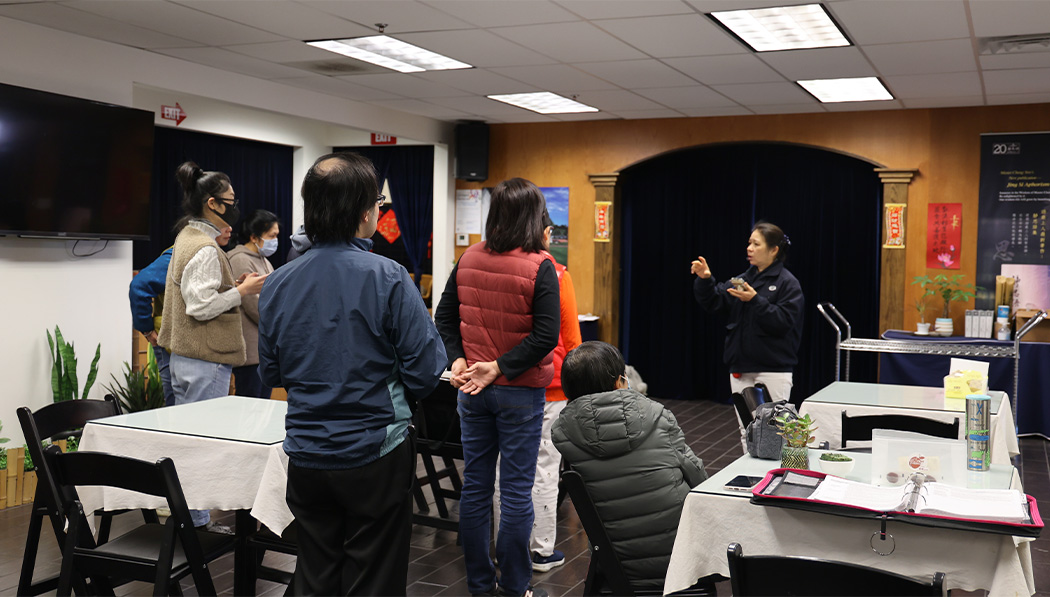

The 2024 tax season started on January 29th and ends on April 15th. Tzu Chi volunteers started the 2024 free Tax Return Preparation Service on Saturday, February 3 at El Monte Service Center. It so happened that Saturday, February 10th, was the first day of the Year of the Dragon. On that day, Tzu Chi volunteers came to the El Monte Service Center to make preparations for the tax return preparation work. Tzu Chi volunteers who are responsible of the free tax return preparation service, Xinying Chen, explained to the volunteers what they need to pay attention to this year’s tax return preparation, because the IRS forms and regulations for filing tax returns are different every year, and the Tzu Chi volunteers needed to familiarize themselves with the rules in order to provide quality tax return preparation services to the public.

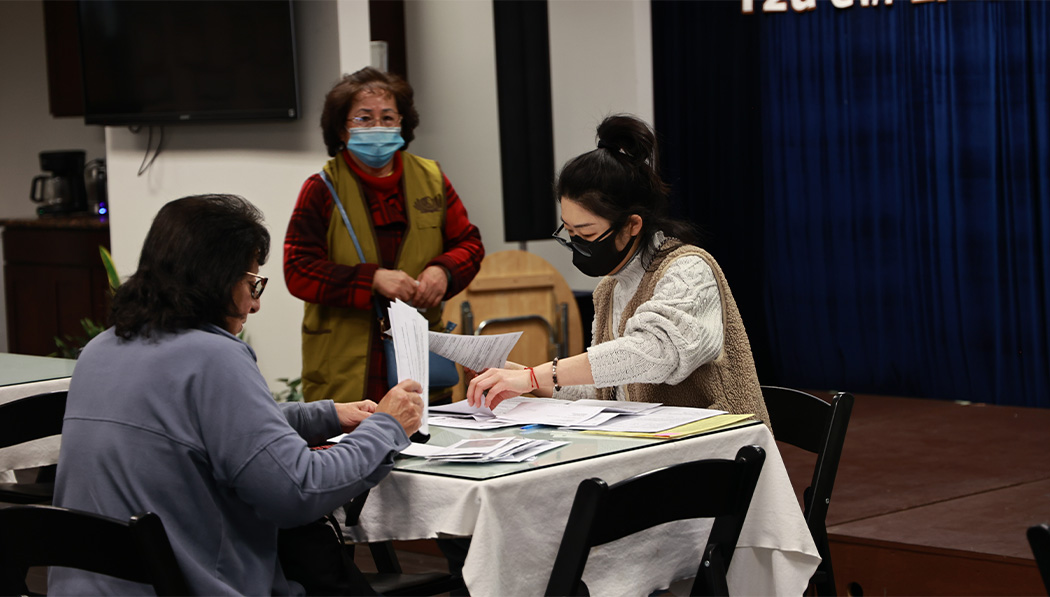

The first family to file their tax return that day was Mr. Raymond Garcia and his wife. Cindy Wei, a Tzu Chi volunteer with many years of experience in tax return preparation service, was responsible for receiving the elderly couple and assisting them in filling out the forms. Many important personal information is required to be filled out in the tax form, people gave their personal information to the Tzu Chi volunteers out of trust. The tax return preparation volunteers paid close attention to protecting the privacy of the people when they filled out the information in detail. In addition, because Tzu Chi volunteers have a full understanding of tax returns, they will advise people to avoid taxes within the scope of the law, which is helpful for underprivileged– and middle-income families.

Tzu Chi’s years of free tax preparation service have established a good reputation in the community, many people who used to file tax returns at other services transferred to Tzu Chi. On that day, the people filing tax returns arrived one after another, there were Asians and Hispanics, and the Tzu Chi volunteers kindly received them and registered their personal information. Other volunteers entered the people’s data into the computer system and then sent them to the IRS to file their tax returns once they were accurate. The people then came back to get the paper copies of their tax returns two weeks later.

Reducing the financial burden of underprivileged families

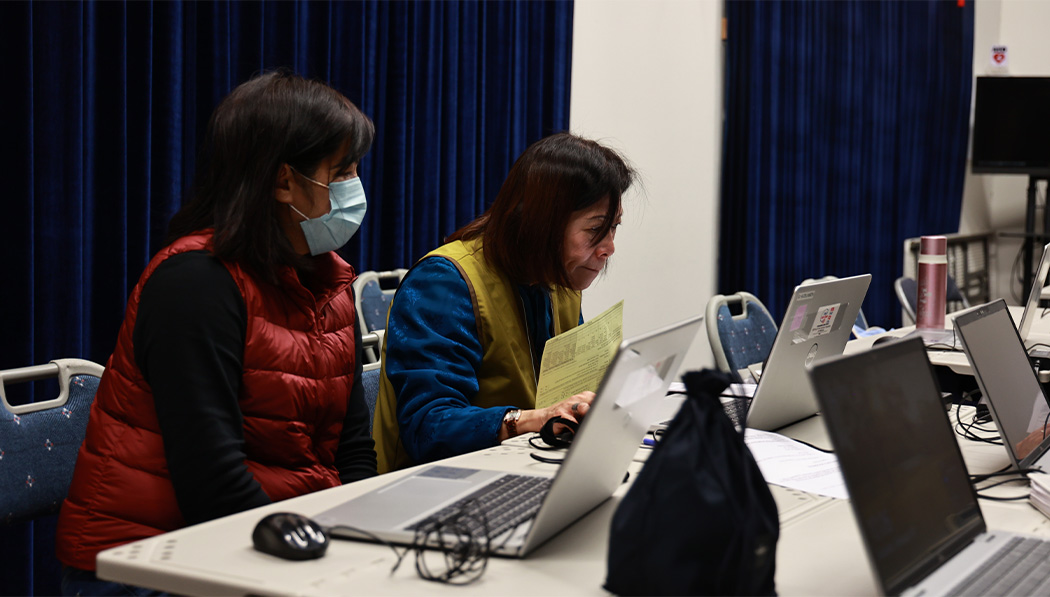

At the tax return preparation site, volunteers with years of experience in filing tax returns shared their experience with new volunteers without reservation, by learning from each other, they strived to improve the quality of their tax return preparation services. Tzu Chi volunteer Cindy Wei said that although she has 17 or 18 years of experience in filing tax returns, she needs to learn new things every year. “It takes us little effort, but the free tax return preparation service is of great help to people with low family income and financial burden; the rising consumer prices add to their financial burden. Whenever we see people smile and appreciate our help, we feel that we should be more grateful and come back every year to learn more.”

Generally, most of the tax return preparation services by accountants charge US$100 to over US$200. Tzu Chi’s free tax preparation services can help people save money and reduce their burden of living.

Cindy Wei, Tzu Chi volunteer

Conditions for Tzu Chi's free tax preparation service

Raymond Garcia said: “This is my third time here. I don’t know how to collect information to file my tax return, but the Tzu Chi volunteers are very patient and explained to me, they are always ready to help others. I feel very comfortable here, everyone is so nice, I really like them and appreciate it very much.”

It’s also the third time for Irma Banuelos to come here to file her tax return. She shared her feelings, “For people like me who lack resources, I like this service because everyone is very friendly. Plus, today is a special day, it’s the Chinese New Year. They take the time to be there for everyone and are very kind. Prices are so expensive nowadays and this free service really helps a lot of people.”

Taxpayers applying for the free tax preparation service are required to meet the following qualifications: gross household income less than $60,000, fewer than five stock transactions in the last year, no income from rentals, no 1040 NR and 1099 MISC income, no married couples filing separately and no cash income. The Tzu Chi El Monte Service Center’s free tax preparation service does not require a phone appointment, people just need to bring all the relevant documents to the Tzu Chi Service Center that provides tax preparation service at the time of the activity. The volunteers will assist in confirming the documents, and if the documents meet the eligibility criteria, they will be received and processed.