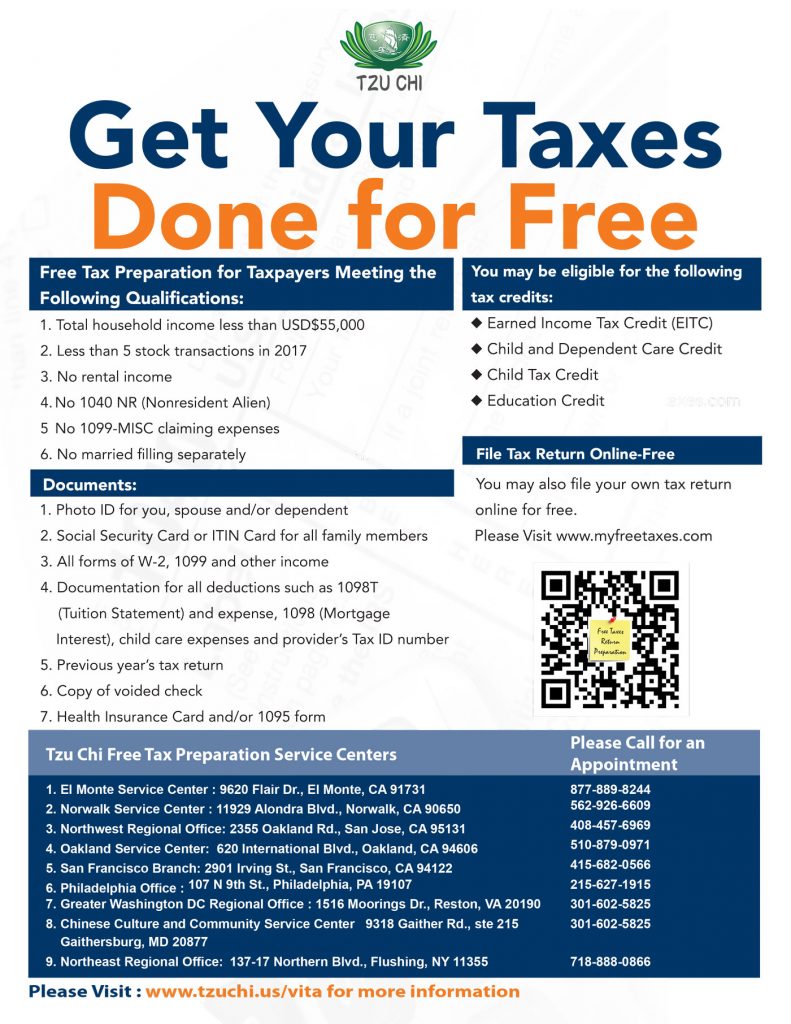

If you earned less than $54,000 last year, you can have your income tax returns prepared for free through the Buddhist Tzu Chi Foundation’s Volunteer Income Tax Assistance (VITA) program.

Certified volunteers will provide free tax assistance to low to moderate income taxpayers who require assistance with completing their tax returns.

Trained community volunteers can assist with special credits, such as Earned Income Tax Credit, Child Tax Credit, and Credit for the Elderly or the Disabled. In addition to free tax return preparation assistance, Tzu Chi Foundation also offers free electronic filing (e-filing), which allows taxpayers to receive their refunds in half the time when compared to returns filed on paper. The process is sped up even further with the option to directly deposit the refunds into a bank account.

Taxpayers must meet the following qualifications for free tax preparation:

- – A total household income of less than $54,000

- – Less than 5 stock transactions in 2017

- – No rental income

- – No 1040NR (U.S. Nonresident Alien)

- – No 1099-MISC expense claims

- – No married individuals filing separately

Be sure to bring the following documents:

- – Photo ID for you, spouse and/or dependent

- – Social Security card or ITIN card

- – All forms for W-2, 1099, and other income

- – Documentation for all deductions, such as 1098T (Tuition Statement) and expense, 1098 (Mortgage Interest), childcare expenses, and provider’s Tax ID number

- – Previous year’s tax return

- – Copy of voided check

- – Health insurance card and/or 1095 form

In compliance with the Affordable Care Act (ACA), taxpayers must bring proof of health insurance for each household member listed on the tax return. For those without health insurance, the exemption certificate number of any marketplace-granted coverage exemption is required. Taxpayers who purchased health insurance through the Marketplace must bring Form 1095-A for tax return service. Listed dependent(s) that have coverage through another taxpayer’s policy are required to bring the policy number and SSN of the other taxpayer.

Please call ahead for an appointment at a regional office near you!

El Monte Service Center

9620 Flair Dr., El Monte, CA 91731

TEL: 877-889-8244

Hours of Service: 2/3 – 4/7

Sat. 9:00am – 5:00pm

Tzu Chi Cerritos

11929 Alondra Blvd., Norwalk, CA 90650

Hours of Service: 2/11 – 4/15

Sat. 9:30am – 5:00pm

Norwalk Service Center

11929 Alondra Blvd., Norwalk, CA 90650

TEL: 562-926-6609

Northwest Regional Office

2355 Oakland Rd., San Jose, CA 95131

TEL: 408-457-6969

Hours of Service: 2/4 – 4/8

Sun & Mon – Wed 10:00am – 3:00pm

Oakland Service Center

620 International Blvd., Oakland, CA 94606

TEL: 510-879-0971

Hours of Service: 1/31- 4/9

Fri, Sat & Sun 10:00am – 3:00pm

San Francisco Branch

2901 Irving St., San Francisco, CA 94122

TEL: 415-682-0566

Hours of Operations: 2/4 – 4/8

Sat. 1:15pm – 5:30pm

Philadelphia Office

107 N 9th St., Philadelphia, PA 19107

TEL: 215-627-1915

Hours of Service: 2/4 – 4/1 and 2/19

Sat. 10:00am – 4:00pm

Greater Washington DC Regional Office

1516 Moorings Dr., Reston, VA 20190

TEL: 301-602-5825

Hours of Operations: 2/5 – 4/9

Sun. 1:00pm – 4:00pm

Chinese Culture and Community Service Center

9318 Gaither Rd., Suite 215, Gaithersburg, MD 20877

TEL: 301-602-5825

Northeast Regional Office

137-17 Northern Blvd., Flushing, NY 11355

TEL: 718-888-0866

Hours of Service: 2/18 – 4/8

Sat.1:00pm – 5:00pm

As an alternative to the VITA service, taxpayers that earned less than $66,000 last year also have the option to prepare their own returns for free by using the MyFreeTaxes software, the Facilitated Self-Assistance (FSA) program sponsored by United Way Worldwide. For more information, please go to www.myfreetaxes.com.