Written by Tina Garcia, Wendy Tsai

Translated by Hong (Ariel) Chan

Edited by Diana Chang, Andrea Barkley

As famed American statesmen Benjamin Franklin once said: “In this world, nothing is certain except death and taxes.” So begins the annual tax season.

Tax filing is troublesome for many in the United States. U.S. taxation laws often change. Moreover, tax law is not only complicated but difficult to understand. Therefore, even though some people have lived in the United States for decades, they still dare not file their own taxes. Some spend money to hire tax accountants for this chore. Filing tax returns is often difficult for low-income people or for whom English is a second language.

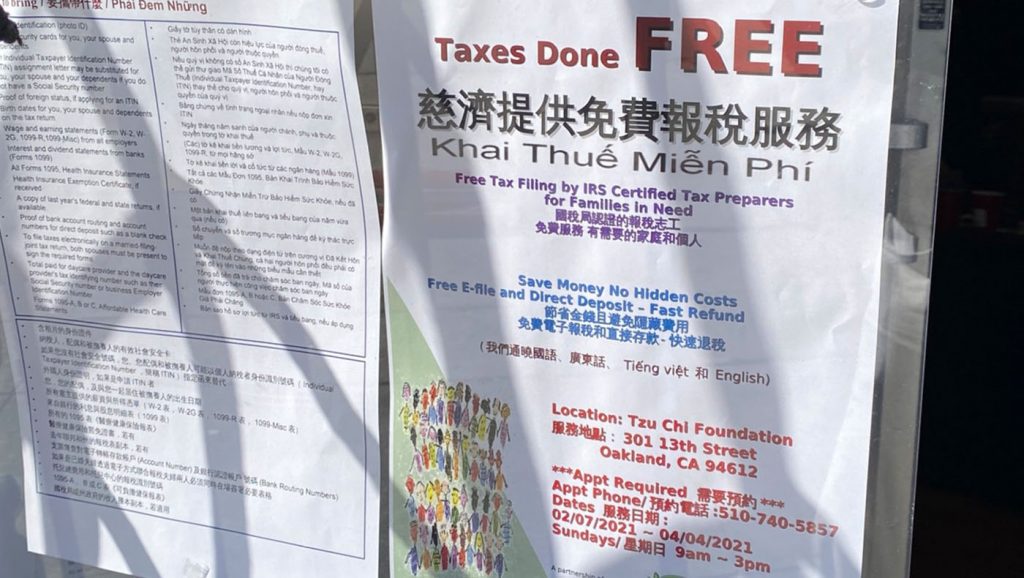

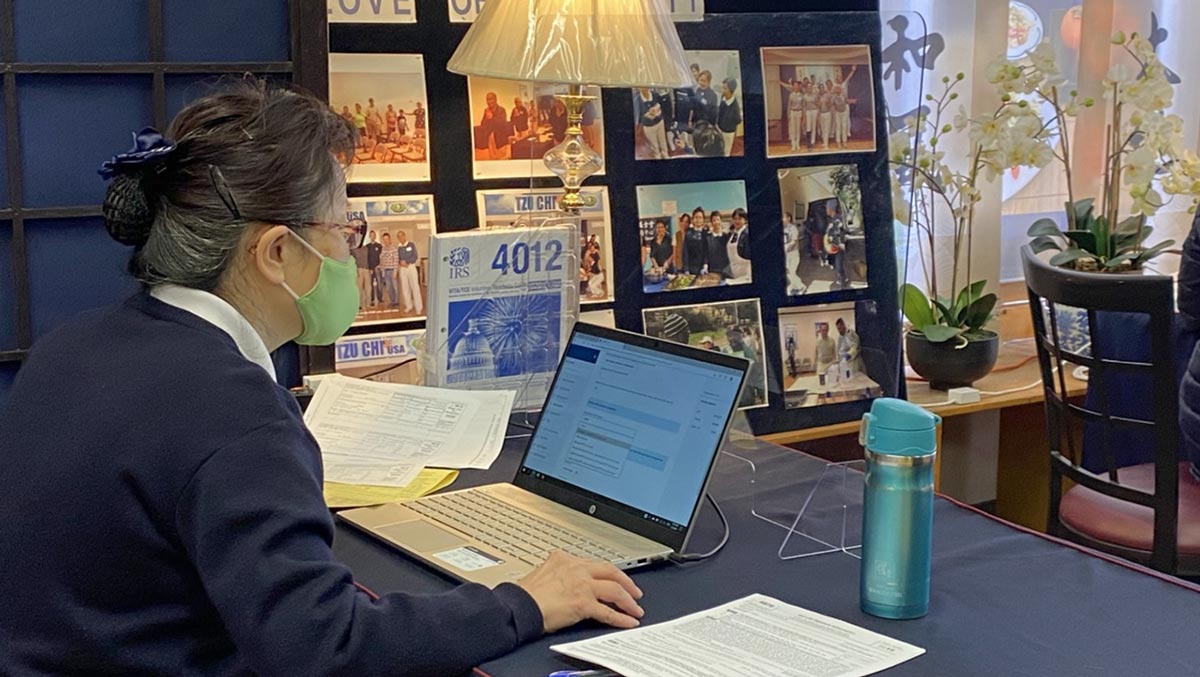

Tzu Chi USA participated in the Volunteer Income Tax Assistance (VITA)— a free tax filing service for low-income taxpayers. In 2021, Tzu Chi USA established VITA services across its many offices and service centers to relieve tax filing challenges in the community.

In the United States, what one earns as “gross pay” (pay before taxes) often looks much different than what one takes home. For example, one might earn $5,000 but pocket less than $4,000. In addition to expenditures such as medical insurance, and union membership fees, income tax also takes away from actual earnings.

There are many complicated factors during tax filing. For example, if you pay more taxes, you must wait for the tax refund to receive your expected salary. On the contrary, if you withheld fewer taxes, you have to compensate for the discrepancies in the following year. Furthermore, you will be fined and pay interest if you pay additional taxes for the differences for several consecutive years. Therefore, during this period, organizations that assist in filing tax returns become very busy. Many people feel they need help with overwhelming tax rules and documents.

No Sleep During the Tax Filing Period

This year the situation became even more complicated. As the pandemic has not ended, institutions assisting in filing tax returns had to establish prevention measures. Despite the COVID concerns, Tzu Chi volunteers decided to provide VITA services. Regardless of the pandemic challenges, they firmly believed in their role to care for the community.

In the past, many organizations also provided the same service. But their discontinuation this year meant more people turned to Tzu Chi USA for help. For example, Tzu Chi’s Greater Washington DC Region Branch each year serves around a hundred residents. However, due to the lack of public services this year, over one and a half times the average amount of people came for assistance.

We have received applications from more than 150 taxpayers in the second week, and the workload is very heavy.

Mark Tsai

Tzu Chi Volunteer

Washington DC Region

Everyone shares the workload. Often we take work home. Sometimes we even skip sleep to ensure we finish the tax returns by the deadline.

Tina Garcia

Tzu Chi Volunteer

Oakland Service Center

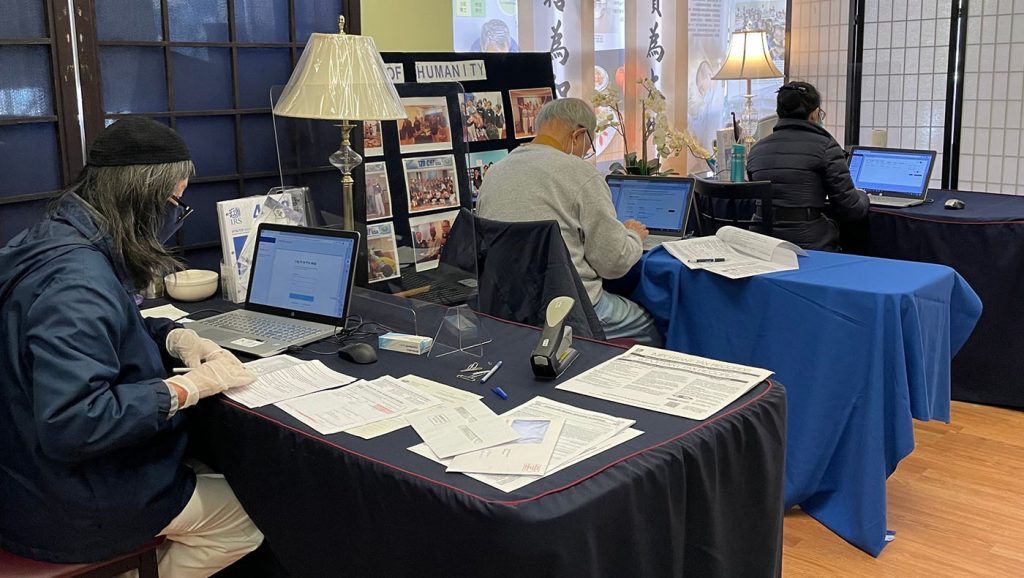

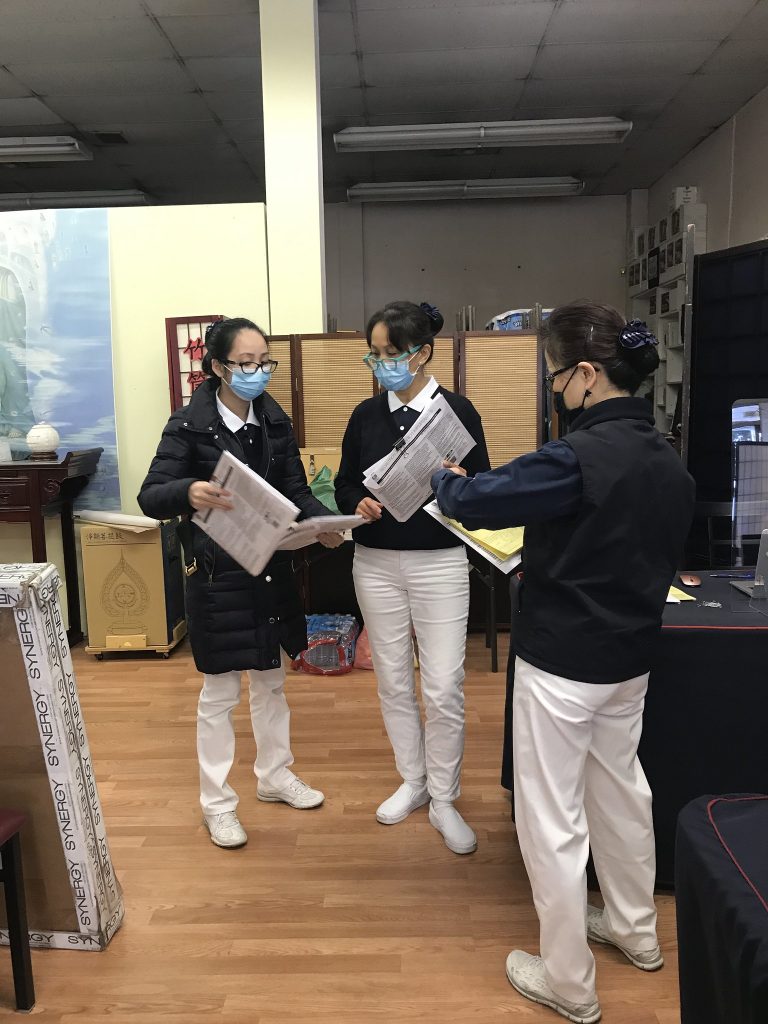

Behind the Scenes at Oakland Service Center

The intensive tax filing service has motivated the volunteers. Every Sunday morning, before the operation hours (10 am to 3 pm), many residents carrying bags of paperwork lined up patiently outside Tzu Chi’s Oakland Service Center. Although this is a service-by-appointment system, many came to stay in line before their appointment. The volunteers took compassion for those waiting in line in the cold, so they also came to help earlier. Volunteer Sai Mei Liu, who was in charge of prep work, decided to assist the volunteers earlier and even offered snacks. Tzu Chi volunteers in Oakland are full of passion for serving their community.

All four Tzu Chi’s Oakland Service Center volunteers continue to support VITA season after season. They have practical experience and years of tax return filing knowledge. Each year they encourage Tzu Chi volunteers and Tzu Shao to join the training organized by the Federal Internal Revenue Service while they closely mentor the progress. As such, the Tzu Chi Oakland Service Center can serve a larger group of people seeking tax return services.

After assisting those who felt helpless at filing taxes, Tzu Chi Oakland volunteers agreed without hesitation that it was all worth it. They understood the feeling of overwhelm that many low-income taxpayers have. In the modern world, this practice becomes a form of benevolence guided by the spiritual teachings of the Master.

Drive-Thru Tax Return Service by Washington DC Region Volunteers

Although Tzu Chi’s Washington DC Region volunteers continued to provide tax filing services during the pandemic, there were fewer onsite volunteers for the first time in years. Most were encouraged to stay at home and comply with pandemic prevention regulations.

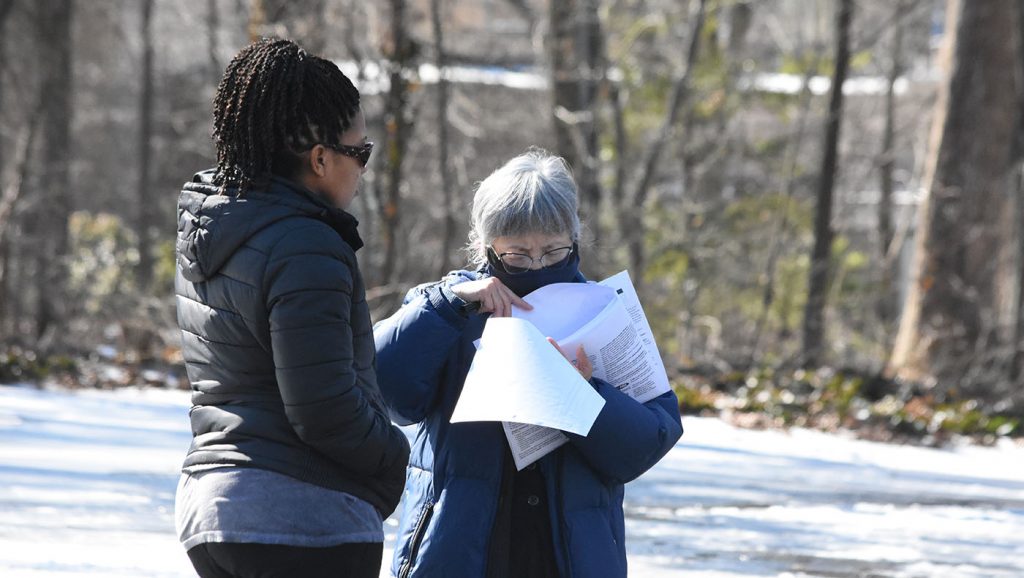

Thankfully, Tzu Chi Washington DC volunteer Mark Tsai (and all the volunteers who assist in tax filing) has several years of experience. Therefore, they knew that some low-income families do not have home computers and could not complete tax filing online. As such, Tzu Chi volunteers planned a flexible process for face-to-face tax filing service too.

The Tzu Chi Washington DC Regional Office provides free tax return services to low-income families from all backgrounds. Photo/Wendy Tsai

“The number of people who came to the Service Center to file tax returns this year has dropped significantly. For those who did show up in person, we had them wait in the parking lot while our volunteers completed their taxes inside. When the volunteers finished, we would return the paperwork outside. Then both parties would sign off to ensure completion,” said Mark Tsai. Tzu Chi volunteers did so to ensure they provided the correct information and services to those needing it.

Free tax filing services could save money for low-income taxpayers. However, the COVID-19 pandemic has yet to be alleviated, and tax filing locations have significantly decreased. Therefore, Tzu Chi’s Washington DC Regional Office expected to serve more than 200 people with this contingency plan before the tax filing deadline on May 17, 2021.